When I think about gift cards, I can’t help but feel a mix of excitement and practicality. They’re like little tokens of freedom, giving us the chance to purchase something we truly want or need without the usual financial commitment. Whether I’m gifting one to a friend or treating myself, they carry a certain allure that always piques my interest. In a world filled with endless options, gift cards seem to simplify the process, making it easier to navigate my desires—especially when I’m in a pinch for ideas.

Gift cards have been around for quite some time now, but they’ve evolved into an incredibly popular gifting option, especially with the rise of online shopping. With roots dating back to the late 20th century, they’ve transformed the way we think about and give gifts. The benefits of owning a gift card go beyond mere convenience; they provide flexibility, allow for personal choice, and can sometimes even unlock better deals at select retailers. Not to mention, they eliminate the pressure of picking the perfect gift, making them ideal for both givers and receivers. In this article, I’ll be taking a closer look at several popular options: the Visa and Mastercard gift cards, which come with associated purchase fees, and the Amazon.com gift card, which offers a balance reload feature. Each one has its own perks and nuances, so let’s explore what makes them stand out.

$100 Visa Gift Card (with $5.95 Fee)

When it comes to selecting the perfect gift card, I have found myself sifting through loads of options. Recently, I came across the Visa $100 Gift Card, and I figured it was time to dig deeper into what makes this card worth considering. It’s non-reloadable, meaning it’s a one-time gift, but it manages to hold its own in many ways. Let me share my experience with it.

The primary use of the Visa $100 Gift Card is pretty straightforward: it’s ideal for gifting someone a versatile spending option without locking them into a specific store or brand. Whether it’s for a birthday, holiday, or just because, this card allows the recipient to use it just like cash at millions of locations that accept Visa. Perfect for those who may have varied tastes—this gift card gives them the freedom to choose what they want.

What draws me to this gift card is its simplicity and versatility. While many gift cards limit spending to specific stores or brands, the Visa gift card can be used anywhere Visa is accepted. This feature is a major plus for me. It allows the recipient to have a wide range of choices rather than restricting them to just one vendor. Moreover, the convenience of having no cash or ATM access makes it a hassle-free option for both the giver and receiver.

The Visa $100 Gift Card is specifically designed for those looking for a gift option that’s not bound by predefined restrictions. Here are some of the key features that stand out to me:

- Non-Reloadable: It comes loaded with a fixed amount, which means no worrying about the balance running low or topping it off.

- No Expiration: The funds do not expire. Even if the valid thru date passes, the remaining balance can still be accessed by calling customer service.

- Active and Ready: The card is shipped active, so it’s ready for immediate use upon receipt.

- Secure Registration: Recipients are encouraged to register the card to protect the funds, a feature I appreciate for peace of mind.

- Purchase Fee: Keep in mind there is a one-time $5.95 purchase fee that applies at checkout, which is typical for these kinds of cards.

I believe the overall quality of the Visa $100 Gift Card is commendable. It fulfills its purpose effectively, and the fact that it can be used almost everywhere makes it a quality choice. The added security of registration provides a layer of protection that I consider essential, especially in today’s world where scams are prevalent. The card feels sturdy and professional, which enhances the gifting experience.

Like anything, the Visa gift card has its pros and cons.

-

Versatile Use: Use at millions of locations that accept Visa.

-

Simplicity: Easy to use with no complicated setup required.

-

No Expiration: Funds don’t expire, giving flexibility to the recipient.

-

Secure: Registration provides coverage against loss.

-

Purchase Fee: The $5.95 fee may seem steep for some.

-

Non-Reloadable: Can’t add more funds once used up.

-

Shipping Restrictions: Not available for residents in certain states, which could limit accessibility for some.

I find the Visa $100 Gift Card to be a solid choice for gifting, thanks to its versatility and ease of use. If you want to give someone the freedom to choose what they really want, this card does a fantastic job delivering that. Just keep the purchase fee in mind, and you’re good to go!

Amazon Gift Card Balance Top-Up

Navigating the world of gift cards can feel a bit overwhelming, especially with so many options out there. I’ve found myself opting for Amazon.com Gift Card Balance Reload for various reasons. Let’s dive into what makes this option stand out to me.

The primary use of the Amazon Gift Card Balance Reload is pretty straightforward: adding funds to my Amazon gift card balance. This allows me to manage my spending more effectively while shopping online. Once I’ve set up my balance, I can shop for everything from electronics to groceries without the fear of overspending. It’s like having a built-in budget that I control directly.

I truly appreciate this product because it simplifies my shopping experience. Rather than tracking multiple payment methods or worrying about credit card bills, I can just reload my gift card balance as needed. Plus, with the Auto-Reload feature, I can set it and forget it. I never have to deal with the anxiety of running out of funds while shopping—whether I’m targeting that perfect gift for a friend or treating myself to something special.

At its core, the Amazon Gift Card Balance Reload is designed to give you greater control over your spending habits. Here are some key features that I find particularly useful:

-

Auto-Reload Functionality: I can automate the process of reloading funds. I simply choose when I want my balance to refill—whether it’s a specific date, weekly, or monthly, or whenever my balance dips below a certain amount.

-

No Expiration and No Fees: The reloaded funds I add to my balance never expire, and there are no hidden fees associated with it. This platform allows me to use my funds whenever I want, stress-free.

-

Quick Checkout: Having funds pre-loaded into my Amazon gift card balance means I can check out much faster. This little efficiency makes the shopping process so much smoother.

While the concept may seem simple, these features work together to create a dependable and enjoyable shopping experience.

I’d say the overall quality of the Amazon Gift Card Balance Reload is impressive. The user interface on Amazon is intuitive, making it easy for me to navigate through loading funds to my balance. Moreover, the transaction process is exceptionally seamless. I’ve never faced issues with the reload process; it always goes through smoothly and the updates to my balance are instant, allowing me to shop right away without delay.

Like anything, there are pros and cons to consider:

-

Flexible Spending Control: I can control how much I want to spend and can adjust my balance as needed.

-

Convenient Auto-Reload: Setting up Auto-Reload was a breeze and has removed the hassle of frequent manual top-ups.

-

No Expiration on Funds: I can plan and save for larger purchases without a time constraint.

-

Easy to Use: The simplicity in managing the balance enhances my overall shopping experience.

-

Non-Refundable: Once I add funds, I can’t get them back unless required by law. This restriction is something to keep in mind if I’m unsure of my spending.

-

Limited to Amazon: While this is fantastic for shopping on Amazon, the funds aren’t usable in other stores, unlike some other gift cards that can be redeemed more widely.

The Amazon.com Gift Card Balance Reload serves as a powerful tool for managing my spending and making online shopping more enjoyable. It aligns smoothly with how I prefer to handle my finances, making it a solid choice in the world of gift cards.

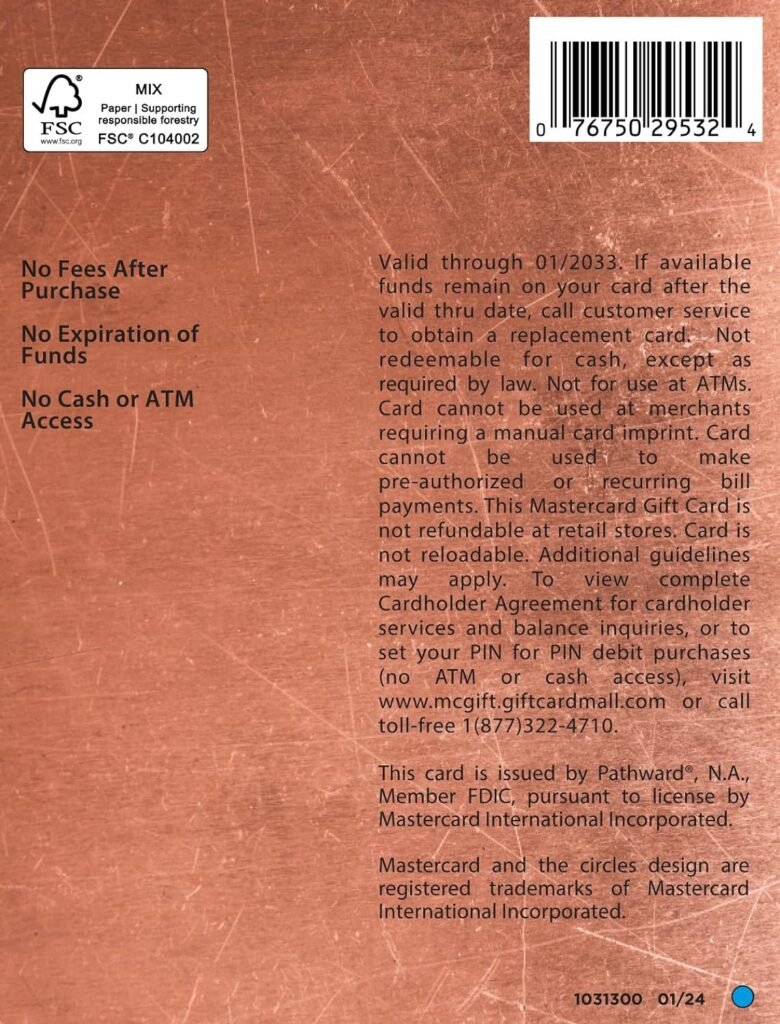

$100 Mastercard Gift Card (+ $5.95 fee)

When I’m on the hunt for gift cards, I often find myself weighing my options carefully. One card that has piqued my interest is the $100 Mastercard Gift Card (plus a $5.95 purchase fee). Here’s how it stacks up against my expectations and needs.

The $100 Mastercard Gift Card is an enticing option for a variety of occasions, from birthdays to holidays, or simply as a thank-you gesture. Because it can be used wherever Mastercard is accepted, including online, I find that it’s a flexible choice. Whether I want to treat a friend to coffee or help them buy that trendy jacket they’ve had their eye on, this card fits the bill. The card is non-reloadable, which makes it simple to manage. I can get it, send it off, and I’m done—no hassles with adding funds later.

What really draws me to this Mastercard gift card is its universal usability. Unlike store-specific cards that limit the recipient’s options, this card allows the recipient to choose what they really want. Plus, the fact that there’s no expiration of funds gives me peace of mind that the recipient isn’t under pressure to spend it quickly. I appreciate that it has no dormancy fees or hidden charges after purchase, making it feel more like a sincere gift rather than a potential burden.

The core purpose of the $100 Mastercard Gift Card is straightforward—it’s designed for gifting without the hassle of selecting a specific item. Here are some key features that stand out:

- Non-Reloadable: Once I’ve purchased it, it stays at the value of $100, which makes it easy to track.

- Widely Accepted: This card works wherever Mastercard debit cards are accepted, offering a level of convenience that’s hard to beat.

- No Expiration: The funds never disappear, so the recipient can use it at their leisure.

- One-time Purchase Fee: The $5.95 fee upfront is something to consider, but it simplifies the overall experience—there are no surprises after the purchase.

- No Cash or ATM Access: It simply can’t be withdrawn as cash, which I see as a pro and a con. Sure, it ensures that the card is used for purchases, but it may disappoint someone hoping for cash.

In terms of overall quality, I would say the $100 Mastercard Gift Card measures up well. It’s convenient, straightforward, and offers the flexibility that most people desire when gifting. I can tell that they’ve thought things through, from the shipping process to ensuring that the card works seamlessly across different platforms. It’s worth mentioning that this card is available for purchase within the United States only, with specific restrictions on certain states like Hawaii and Vermont.

Let’s break down what I see as the pros and cons of this gift card:

-

Versatile Use: Accepted almost anywhere Mastercard is, making it a great gift.

-

No Hidden Fees After Purchase: Just the upfront cost, which is refreshing.

-

No Expiration: Perfect for those who take their time deciding what to buy.

-

Purchase Fee: The $5.95 fee can be a bit of a turn-off for some.

-

Non-Reloadable: Once it’s spent, that’s it—no topping up for more.

-

No Cash Access: Great for spending, but not ideal if the recipient wants cash.

All in all, the $100 Mastercard Gift Card (plus $5.95 purchase fee) stands out for its convenience and broad usability. If I’m looking for a straightforward gift that gives the recipient freedom and flexibility, this is a solid choice on my list.

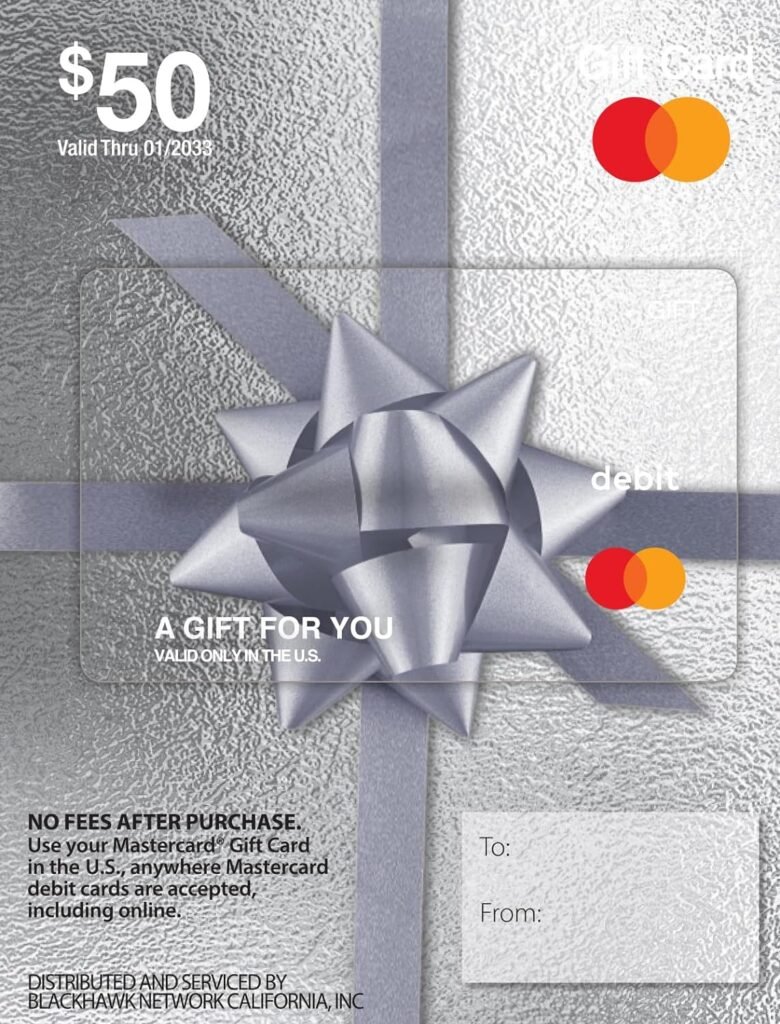

$50 Mastercard Gift Card (with $4.95 fee)

When it comes to gift-giving or treating myself, I often find myself reaching for gift cards. One that has caught my eye is the $50 Mastercard Gift Card. It’s a solid choice for those who want the flexibility to shop anywhere Mastercard is accepted, whether that’s in-store or online. I love the idea of being able to use this card at my favorite retailers without worrying about the limitations that come with some store-specific gift cards.

There are a few reasons why I gravitate towards the $50 Mastercard Gift Card. For starters, the non-reloadable feature means that once I’ve used the balance, I won’t have to deal with confusing top-up processes. I appreciate the lack of expiration on funds, too. It gives me the peace of mind to spend the gift card when I want, rather than racing against a clock. Plus, I can use it online, making it perfect for my last-minute shopping sprees for that uniquely awesome gift.

The $50 Mastercard Gift Card serves as a highly versatile option for gift-giving or personal use. Let’s dive into the key features that make it stand out:

- Non-Reloadable: This means that once I use the $50, that’s it — there’s no need to worry about refills.

- No Expiration of Funds: Unlike some gift cards that push me to spend quickly, this card allows me the luxury of time.

- Ready to Use: The card is shipped directly to me, so I can start using it right away without any activation process.

- Widely Accepted: I can shop online or in-store wherever Mastercard is accepted, opening up countless shopping opportunities.

- Simple Fees: There’s only a one-time purchase fee of $4.95, which I find reasonable for the convenience this card provides. Plus, after that initial fee, there are no hidden charges like dormancy fees.

However, it’s good to know that the card is not eligible for refund, resale, or return, so it’s essential that I use it wisely. Additionally, there are a few shipping restrictions if I happen to live in certain states.

From my experience, the overall quality of the $50 Mastercard Gift Card is impressive. I appreciate that it doesn’t come with a ton of extra fees after the initial purchase fee, allowing me to budget effectively. With such a reliable card on my hands, I never feel rushed to spend my funds. The card’s design is also visually appealing, which is a bonus if I’m gifting it.

Like any product, the $50 Mastercard Gift Card has its bright sides and drawbacks.

-

Universally Accepted: I can use it anywhere Mastercard debit cards are accepted, giving me a lot of flexibility.

-

Non-reloadable: This is ideal for people like me who prefer simplicity — no need to worry about adding more money later.

-

No Expiration of Funds: The absence of expiration means I can take my time choosing what I want to buy.

-

Low Initial Fee: The $4.95 fee is relatively low for the convenience I get.

-

Non-refundable: Once purchased, I can’t get my money back, so I need to ensure it’s something that I or the recipient will use.

-

Shipping Restrictions: Some areas have limitations on where these cards can be sent, which could be an inconvenience.

-

No Cash Access: I can’t withdraw cash or use it at ATMs, which limits its utility in some cases.

Choosing a gift card is all about weighing these features against my own needs, and the $50 Mastercard Gift Card does provide a lot of value for various occasions. As always, it’s crucial to assess what works best for my specific situation, but this card certainly stands out from the crowd!

$25 Mastercard Gift Card (with $3.95 fee)

When it comes to gift-giving, I find the $25 Mastercard Gift Card to be a top contender for flexibility. My primary use of this card has been as a versatile present for various occasions, whether it’s a birthday, holiday, or just a little something to show I care. The beauty of this card is that it’s accepted everywhere Mastercard debit cards are, which means the recipient can shop at their favorite stores or online platforms without any hassle.

What stands out to me about the $25 Mastercard Gift Card is its convenience and ease of use. Unlike some gift cards that can be limited to specific retailers or have expiration dates, this card offers peace of mind with no expiration of funds. I also appreciate that there are no hidden fees that crop up after the purchase—just a straightforward one-time purchase fee of $3.95. This transparency makes it a trustworthy option in my book.

This card serves as a simple tool for gifting, allowing the recipient to choose what they truly want or need. The $25 Mastercard Gift Card comes with a few key features worth highlighting.

- Non-reloadable: Once you’ve purchased it, you can’t add more funds, which simplifies things. You know what you’ve spent, and that’s that.

- No cash or ATM access: This limits the temptation for the recipient to withdraw cash. Instead, it encourages them to spend it on something enjoyable.

- Ready to use: Unlike some gift cards that require activation, this one comes shipped and ready to go, which adds another layer of convenience.

The straightforward nature of this card—paired with its wide acceptance—makes it perfect for almost any gifting scenario.

In terms of quality, I rate the $25 Mastercard Gift Card quite high. The fact that it doesn’t come with ongoing fees after that initial purchase fee is a huge win. The card is delivered ready to use, which takes away any last-minute activation worries. Every time I’ve handed one of these cards over as a gift, I’ve felt confident that it would be well-received and used without any complications.

Like any product, the $25 Mastercard Gift Card has its pros and cons, and I think it’s important to weigh both.

-

Flexibility: Can be used almost anywhere Mastercard is accepted.

-

No expiration: The funds never expire, meaning the recipient can take their time selecting what they want.

-

Transparent fees: A single $3.95 purchase fee without additional charges is refreshing.

-

Ready to use: No activation or waiting time means the card can be used immediately.

-

Non-reloadable: Once the balance is spent, that’s it. There’s no adding more money later.

-

No cashback: The inability to access cash or ATM services can be seen as a drawback.

-

Limited availability: It can’t be shipped to certain states, which can be a hassle if I have someone living in one of those areas.

-

Potential scams: The lack of cash access can make it attractive to scammers, so I always remind recipients to be cautious.

My experience with the $25 Mastercard Gift Card has been overwhelmingly positive. It provides a practical gifting solution that meets a variety of needs while being simple and transparent. Whether I’m using it for a special occasion or just as a little pick-me-up gift, this card has frequently hit the mark for me.

Comparison of Gift Cards

When I was considering gift cards, I found a range of options, each with their unique features and costs. It’s easy to get tangled up in the web of product descriptions, purchase fees, and usability. So, to make things simpler for myself (and you), I decided to lay it all out in a comparison table along with some key specifications.

Product Specifications

Here’s a table that captures the essential details of each gift card:

| Product | Amount | Purchase Fee | Reloadable | Cash/ATM Access | Expiration | Usable For |

|---|---|---|---|---|---|---|

| Visa $100 Gift Card | $100 | $5.95 | No | No | Never | Anywhere Visa is accepted |

| Amazon.com Gift Card Balance Reload | Varies | $0 | Yes | No | Never | Amazon.com |

| Mastercard $100 Gift Card | $100 | $5.95 | No | No | Never | Anywhere Mastercard is accepted |

| Mastercard $50 Gift Card | $50 | $4.95 | No | No | Never | Anywhere Mastercard is accepted |

| Mastercard $25 Gift Card | $25 | $3.95 | No | No | Never | Anywhere Mastercard is accepted |

Analysis

Visa $100 Gift Card This one allows versatility as it can be used anywhere Visa debit cards are accepted. However, the $5.95 purchase fee and its non-reloadable nature make it a bit of a one-and-done deal. You get $100 to spend, but that’s it—once it’s gone, it’s gone.

Amazon.com Gift Card Balance Reload On the other hand, this option feels quite different. It lets me add funds to my Amazon balance whenever I want, which is pretty handy. I can also set up Auto-Reload to keep things automated. There’s no purchase fee, and the funds never expire. This makes it ideal for regular Amazon shoppers like me!

Mastercard Gift Cards ($100, $50, $25) These Mastercard options come with varying amounts and purchase fees. They all function similarly, allowing purchases wherever Mastercard is accepted. The fees range from $3.95 to $5.95 based on the card amount, so if I’m looking to gift a smaller amount, the $25 card is tempting with the lowest fee. However, none of these cards are reloadable, which means once I spend the balance, I’d have to get another.

Conclusion: Reflecting on Gift Card Options

Having explored various gift card options, I found each one brings its own unique strengths, while also carrying certain drawbacks that are worth considering.

Overview of Each Product

- Visa $100 Gift Card ($5.95 fee): A solid choice if you want flexibility, but that purchase fee might feel a bit steep to some. It’s great for those who cherish the freedom of using their gift card anywhere Visa is accepted.

- Amazon.com Gift Card Balance Reload: Seamlessly reload your balance, which is perfect for the avid Amazon shopper in my life. No fees here, but it’s less ideal for anyone wanting to spend their gift card elsewhere.

- $100 Mastercard Gift Card ($5.95 fee): Similar to the Visa card, the higher price tag may deter those on a budget, though its usability is a plus for anyone who enjoys shopping across varying platforms.

- $50 Mastercard Gift Card ($4.95 fee): A more affordable option that retains the same versatility as its bigger sibling, which is great for gifts that don’t require a grand gesture.

- $25 Mastercard Gift Card ($3.95 fee): The smallest offering, perfect for a quick gift or a stocking stuffer. Then again, the fee might take away some of that expressive joy.

Weighing the Drawbacks

While I appreciate the flexibility that these cards offer, I can’t help but notice the purchase fees can feel a little draining, especially for the smaller denominations. If I’m giving a gift, I want it to feel lavish, not pinched.

Recommendations for Specific Audiences

For those who frequently shop online and appreciate a bit of flexibility, I’d recommend the Visa gift card or the $100 Mastercard option. They cater well to a variety of spending preferences. However, if you’re gifting to someone who prefers the convenience of a specific retailer, the Amazon gift card makes perfect sense—no fees and instant gratification.

Ultimately, whether for a close friend or a casual acquaintance, these gift cards can offer a personalized touch. Just be sure to weigh the fees against your gifting intentions. I’d suggest thinking about the recipient’s shopping habits and what would truly delight them before making a decision.

Disclosure: As an Amazon Associate, I earn from qualifying purchases.